It is really tough to find good investments these days from interest oriented income. Iy is really tough to find investments that pay 4 to 6% unless you are going with higher risk investments. Triple B rated bonds and stocks sometimes offer this kind of yield. But then they are higher risk than many other companies that have a triple A rating. You have to trade high yield for high risk stocks and bonds.

It is really tough to find good investments these days from interest oriented income. Iy is really tough to find investments that pay 4 to 6% unless you are going with higher risk investments. Triple B rated bonds and stocks sometimes offer this kind of yield. But then they are higher risk than many other companies that have a triple A rating. You have to trade high yield for high risk stocks and bonds.

Be prepared to accept the volatility of some of these investments. It is really quite simple. High yield and high risk vs. low yield and low risk. Each investor must decide what level of risk they can tolerate and how much money they want to risk. Can you afford to deal with volatility and worse, partial permanent loss in your capital? Remember if you sell on a down day, you have locked in your losses.

Dividend Income vs. Interest Income – Buying Commercial Bonds

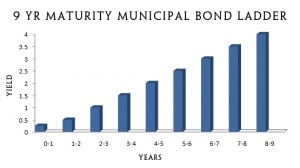

The bond market is apparently much larger than the stock market and yet it seems to get much less press than the stocks do. Bonds can be purchased any day from most companies at various rates and terms. Bonds are all rated based on the company that is selling them and depending on the coupon rate and term, may sell at par value, higher or lower to provide a yield rate that you can compare to other interest bearing certificates.

The yield rate is a very important number since it indicates the real return that you should expect to receive based on what you are actually paying for a bond. For example a bond that is priced at $110 per unit of $100 means that you will pay $5500 for a bond that has a value of only $5000. If the coupon rate is 5% then you will receive 5% of $5000 every year or $250 in income. Since you paid $5500, the real yield is $250 / $5500 or 4.54%

It is very important to understand this concept, since the yield reflects the real return you will receive on your money. Bonds vary in price based on the coupon rate they carry, the term to maturity, whether there is a call allowance on them and what the prevailing interest rate is for interest bearing investments. Once you know the price of the bond and the coupon rate, you can calculate the yield you will receive on the money you make available for investment.

Dividend Income vs. Interest Income – Dividend Income

If you focus on dividend paying stocks, they can be measured using yield rates as well. If a stock is worth a $100 and they pay an annual dividend of $4, then the yield at that time is 4%. However the value of stocks vary a great deal since they are traded daily on the stock market. A $100 stock might be $95 one day and a$105 the next day with corresponding changes in the yield rate.

If the stock appreciates in value over time, then not only do you still get the dividend for as long as you hold the stock, you may also make a profit if you sell the stock at a higher value than what you paid for it.

When you calculate yield on stocks for both growth as well as dividends, you must also take into account the commission charge from your broker. Some people use discount brokers were others use full service brokers. Regardless which one you use, you should take this cost into account. Especially when calculating the overall yield rate for growth and income related to stocks.

Should I Buy Dividend Paying Stocks or Bonds?

The answer is probably yes to both. You want to be diversified and stay conservative in terms of going with high quality investments that are invested for the long term. Bonds have slightly less risk associated with them. However there is no growth potential if you keep the bond until it matures. Stocks on the other hand may appreciate in value over time, however there are no guarantees. The stock market varies a great deal almost every day.

This post should be considered a brief high level discussion on the subject of dividend income vs. interest income. We will discuss additional issues associated with each in future posts. Comments are welcome about either that will assist our readers in understanding the benefits of either.

For more ideas about investing, click here.

Save

Highly effective investing characteristics are not usually the strengths portrayed by our politicians and yet many of us rely on our governments to provide us with a security blanket if we get laid off, get sick or get ourselves in trouble financially. Personally I would rather depend on myself to embrace the techniques of highly effective investing to make sure that my investments do well and provide the quality of life I am most interested in for my retirement lifestyle. The following is our list of techniques to consider.

Highly effective investing characteristics are not usually the strengths portrayed by our politicians and yet many of us rely on our governments to provide us with a security blanket if we get laid off, get sick or get ourselves in trouble financially. Personally I would rather depend on myself to embrace the techniques of highly effective investing to make sure that my investments do well and provide the quality of life I am most interested in for my retirement lifestyle. The following is our list of techniques to consider.