Rent Your Home to Retire Early

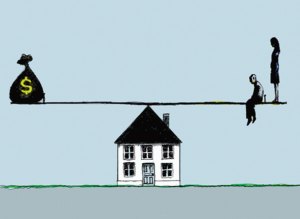

Should you rent your home to retire early? This is the question many people ask themselves at various stages in life. Retired baby boomers traditionally have a home they have owned for many years. It is paid off and worth a small fortune. Should they unlock this value by remortgaging, selling and renting or take a reverse mortgage? What about millennials just starting out. Should they buy a home now and incur all of the maintenance expenses, taxes etc along with interest payments on the mortgage? Or should they rent an apartment and set aside the savings for investment?

Should you rent your home to retire early? This is the question many people ask themselves at various stages in life. Retired baby boomers traditionally have a home they have owned for many years. It is paid off and worth a small fortune. Should they unlock this value by remortgaging, selling and renting or take a reverse mortgage? What about millennials just starting out. Should they buy a home now and incur all of the maintenance expenses, taxes etc along with interest payments on the mortgage? Or should they rent an apartment and set aside the savings for investment?

These are hard questions and many do not have easy answers. There are some fundamental truths that everyone should consider before making a decision. Every person will answer them differently. It is very important that you assess these questions from a personal perspective before making a decision.

Rent your home to retire Early – Fundamentals

- Will you save and invest your savings from renting

- Can you deal with the risk associated with your investments

- Income from work only will not allow you to retire early

- Must have investments that grow on their own – real estate, stocks, equities

- Can you live in a frugal manner

- Do you have the discipline to save for retirement

- Do you have the discipline to not touch your savings

These and a few other questions basically describe someone who is a risk taker, focused on saving, understands that they need to invest in something that will grow over time in addition to the money he or she puts in.

You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

Leave a Reply