Many consumers do not have a financial plan and have no idea of whether they have enough set aside for retirement or not. Many lose sleep at night worrying about this question and sometimes even ruin their health. The Top financial plans for consumers include meeting with a financial adviser who is willing to help them figure out a budget and savings strategy. There is really only one way to deal with this issue. The only way to figure this out is to look at the following elements of a total financial plan to understand their situation:

Many consumers do not have a financial plan and have no idea of whether they have enough set aside for retirement or not. Many lose sleep at night worrying about this question and sometimes even ruin their health. The Top financial plans for consumers include meeting with a financial adviser who is willing to help them figure out a budget and savings strategy. There is really only one way to deal with this issue. The only way to figure this out is to look at the following elements of a total financial plan to understand their situation:

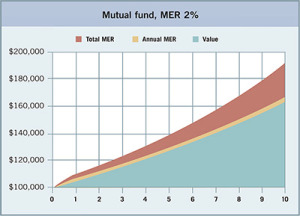

- How much do they have in savings and how will it grow over time

- Will they have enough in savings by retirement

- How much income will be generated from savings, private and public pensions?

- What is their expense budget to-day and what will it be in retirement

- What will they do in retirement to occupy their time and challenge themselves?

If you can answer these questions you are well on the way to developing your financial plan and taking the steps you need to make sure that your income in retirement will match your expenses. The following are a few stats from a recent survey that was completed, which readers may find interesting.

Top financial plans for consumers

- How can I save and pay down my debt?

- Can I afford the lifestyle I want in retirement?

- When can I retire

- How can I reduce my taxes and grow my net worth faster?

- Should I pay off my mortgage or concentrate on my retirement savings?

The top five financial planning recommendations to help consumers deal with their financial concerns

- Pay yourself first is a simple and effective long time approach

- Develop a plan, printed it out, and review it with a financial planner

- Reduce your most expensive debts as quickly as you can

- Learn about all tax saving options

- Make regular contributions to your retirement plan

What do consumers think about their finances?

- Only half of the consumers have a financial plan

- One-third of consumers plan on reducing their debt

- Only one-quarter of consumers are confident that they can manage their debt

- Holiday seasons contribute significantly to increases in consumer debt

For more financial advice posts, click here.