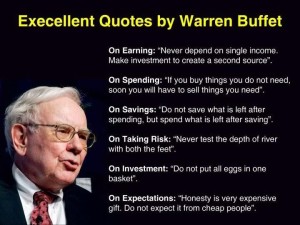

Looking to improve your money management in the years ahead? Here are 31 rules for the Financial Rules for the Road Ahead. While they might not all apply to your personal situation, pick and choose the ones that make sense for your personal situation. Talk to experts to get some help regarding the best approach to take. These rules can be considered general guidelines. Everyone can and probably will apply them a little differently than another person. But take the time to read them. Even doing one thing differently might just make your financial life a lot better. Good reading and good luck managing your retirement finances.

Looking to improve your money management in the years ahead? Here are 31 rules for the Financial Rules for the Road Ahead. While they might not all apply to your personal situation, pick and choose the ones that make sense for your personal situation. Talk to experts to get some help regarding the best approach to take. These rules can be considered general guidelines. Everyone can and probably will apply them a little differently than another person. But take the time to read them. Even doing one thing differently might just make your financial life a lot better. Good reading and good luck managing your retirement finances.

Financial Rules for the Road Ahead

1. Check your retirement progress by taking your nest egg and applying a 4% annual portfolio withdrawal rate, equal to $4,000 a year for every $100,000 saved. Will you have enough retirement income—or should you be saving more? 4% is considered the industry average.

2. Don’t automatically claim Social Security or CPP (Canada) at age 60. It often makes sense to delay benefits so you get a larger monthly check unless your genetics suggest otherwise.

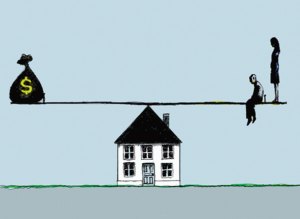

3. Never buy a home unless you expect to stay put for at least five years or longer. Between mid-2006 and early 2012, the S&P/Case-Shiller U.S. National Home Price Index plunged 27.4%.

4. Planning to remodel your home? If you’ll get a lot of pleasure from the improvements and you can afford the cost, go ahead. But don’t kid yourself that you’re making an investment, especially those high priced renovations.

5. Never use a custodial account to save for college costs. Focus on a tax-free growth account.

Avoid Student Loans

6. Don’t let your children take on more student loans than they can reasonably handle, given their expected career and likely earnings. Don’t jeopardize your own retirement by helping them out more than you should.

7. Insure against the big financial risks in your life, while skipping the small stuff. Always take health travel insurance, especially Canadians traveling to the U.S.! Extended warranties, trip-cancellation insurance, and low auto-insurance deductibles? Just say no provided you can afford to self insure.

8. If you aren’t rich, buy term life insurance to protect your family. If you’re super-rich, consider cash-value life insurance to save on estate taxes. Re-evaluate each year.

9. Worried about layoffs? Limit your fixed living costs to 50% or less of your pretax income. Fixed costs include expenses such as mortgage or rent, property taxes, debt payments, groceries, utilities, and insurance premiums. At the 50% level, you know that—with money from your emergency fund—you could get by on half your old income if you lose your job.

Prioritize Your Expenses

10. Think about which expenditures gave you a lot of pleasure in the past year and which were quickly forgotten. Use that to guide your spending in future years

11. Always contribute at least enough to your employer’s 401(k) plan (RRSP for Canadians) to get the full matching contribution. Even if you leave your employer, immediately cash out your 401(k), and pay taxes and penalties, you’ll likely still come out ahead. Canadians can sometimes transfer RRSP’s to managed or locked-in accounts.

12. Expect modest returns from stocks and bonds. The worst that will happen is you’ll save too much. The average return has been in the range of 7% over the long term with significant swings in the market both positive and negative.

13. Think about your paycheck—and how secure it is—as you decide how big an emergency fund to hold and how much debt to take on.

Invest in What You Understand

14. Avoid investments you don’t understand. Among other financial products, that likely means skipping equity-indexed annuities, leveraged exchange-traded index funds, hedge funds and mutual funds that mimic them, and variable annuities with living benefits.

15. Shun investments with high expenses or whose costs you don’t fully grasp.

16. Never keep 100% in stocks—or 100% in bonds. A well-designed portfolio will always include both investments. Diversity is the key to surviving wide swings in the market and interest rates over the long term.

17. Buy individual company blue-chip dividend-paying stocks, and think hard before purchasing actively managed mutual funds. Some charge as much as 2% of the balance whether they make money or not! Corporate blue-chip bonds are also good.

Tax Efficient Investments

18. Check that you have tax-efficient investments in your taxable account while using your retirement accounts to hold investments that generate big annual tax bills.

19. When did you last re-balance your portfolio back to your target weights for stocks, bonds, and other investments? If it’s been over a year, it is time to review.

20. If rich stock valuations and skimpy bond yields make you nervous, you can always pay down debt instead especially if interest rates begin to rise.

21. Never have a year when you pay nothing in income taxes. Take advantage of a low tax bracket by converting part of a traditional IRA to a Roth. In Canada convert RRSP’s to TFSA’s.

Monitor Your Credit Report

22. Check your credit reports for inaccuracies.

23. Always pay your bills on time. This is likely the biggest factor affecting your credit score. In particular, late payments on credit-card bills and loan payments are quickly reported to the credit bureaus.

24. Are you on track to pay off your mortgage by retirement? If not, consider making extra principal payments.

25. Never carry a credit-card balance, which might cost you 20% or more in annual interest. You’ll never earn that sort of return in the financial markets over the long haul.

26. If you have more than enough saved for your own retirement, consider taking advantage of gift-tax exclusion to make gifts to your children and other family members. It’s a great way to brighten their lives—and the cheapest and easiest way to reduce the potential hit from state and federal estate taxes. Also, use TFSA’s to reduce tax on investment income in Canada.

Always Have a Will

27. Get a will. You’ve been promising to do so for years. Make it happen.

28. Check that you have the right beneficiaries listed on retirement accounts, life insurance, and any trust documents. Let’s face it: You probably don’t want your ex-husband inheriting your individual retirement account.

29. Try not to spend money in Roth IRAs. Instead, leave these accounts untouched for your beneficiaries, who could enjoy decades of tax-free withdrawals.

30. When giving to charity, consider gifting appreciated investments. You’ll potentially enjoy three tax benefits: an immediate tax deduction, avoiding capital-gains taxes on the investments donated, and a smaller taxable estate.

31. Keep an eye on the big picture: You want to design a financial life for yourself where money worries are minimal, you have special times with friends and family, and you devote your days to activities that you think are important and you’re passionate about.

For more financial advice, click here.

It takes effort and discipline to become financially stable and to stay that way. Even a temporary relaxation of your financial judgement can jeopardize your stability. Spending too much on a credit card, going on a trip you cannot afford, taking on more debt than you should are examples of what not to do. Becoming financially stable and successful also has benefits as well. For example your stress level will be much less. You can relax more when you are not worried about money. Take the time to review where you are when it comes to the following suggestions to become financially stable and successful. What changes do you need to make in your life?

It takes effort and discipline to become financially stable and to stay that way. Even a temporary relaxation of your financial judgement can jeopardize your stability. Spending too much on a credit card, going on a trip you cannot afford, taking on more debt than you should are examples of what not to do. Becoming financially stable and successful also has benefits as well. For example your stress level will be much less. You can relax more when you are not worried about money. Take the time to review where you are when it comes to the following suggestions to become financially stable and successful. What changes do you need to make in your life?